sales tax rate in tulsa ok

As far as other cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard. This rate includes any state county city and local sales taxes.

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

2020 rates included for use while preparing your income tax deduction.

. Oklahoma State Sales Tax. The latest sales tax rate for Tulsa OK. The current total local sales tax rate in Tulsa OK is 8517.

This is the total of state county and city sales tax rates. Tulsa County Sales Tax. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. Heres how Tulsa Countys maximum sales tax rate of 10633 compares to other counties around the. The average combined tax rate is 893 ranking 6th in the US.

The most populous zip code in Tulsa County Oklahoma is. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402.

Sales tax at 365. Oklahomas sales tax rates for commonly exempted categories are listed below. Rates include state county and city taxes.

Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Depending on local municipalities the total tax rate can be as high as 115.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Effective May 1 1990 the State of Oklahoma Tax Rate is 45.

Interactive Tax Map Unlimited Use. The House and Senate spent the last day of the. 2020 rates included for.

The most populous location in Tulsa County Oklahoma is Tulsa. The average local rate is 443. 2483 lower than the maximum sales tax in OK.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. 2020 rates included for use while preparing your income tax deduction. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. In addition to taxes car purchases in Oklahoma may be subject to other fees like. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax.

Tulsa County collects a 0367 local sales tax less than the 2 max local sales. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. 7288 TULSA CTY 0367 7388 AGONER CTY W 130 7488 ASHINGTON CTY W 1.

They do not have a sales or use tax. Tulsa County - 0367. 2 to general fund.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. For tax rates in other cities see Oklahoma sales taxes by city and county. 20 hours agoThe Oklahoma Legislature has adjourned the 2022 regular session but plans to return next month to discuss more tax relief.

The City has five major tax categories and collectively they provide 52 of the projected revenue. You can find sales taxes by zip code. Ad Lookup Sales Tax Rates For Free.

Depending on local municipalities the total tax rate can be as high as 115. The 2018 United States Supreme Court decision in South Dakota v. You can print a 8517 sales tax table here.

Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The December 2020 total local sales tax rate was also 4867. Including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables.

Did South Dakota v. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

State of Oklahoma - 45. Real property tax on median home. The Tulsa sales tax rate is.

31 rows The latest sales tax rates for cities in Oklahoma OK state. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is. There is no applicable special tax.

The Tulsa County Sales Tax is collected by the merchant on all qualifying sales made within Tulsa County. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Wayfair Inc affect Oklahoma.

Broken Arrow Sales Tax. Sales Tax State Local Sales Tax on Food. 608 rows 2022 List of Oklahoma Local Sales Tax Rates.

The average cumulative sales tax rate between all of them is 828. This rate includes any state county city and local sales taxes. The County sales tax rate is.

The December 2020 total local sales tax rate was also 8517. 0188 ADAIR CTY 175 0288 ALFA CTY ALF 2. The Tulsa County sales tax rate is.

This is the total of state and county sales tax rates. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax. Tulsa collects a 4017 local sales tax the maximum local sales tax allowed under.

The Oklahoma OK state sales tax rate is currently 45. The Oklahoma sales tax rate is currently. 11 to capital fund.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The cost for the first 1500 dollars is a flat 20 dollar fee.

Oklahoma state use tax must be paid on tangible personal property purchased and. The Oklahoma OK state sales tax rate is currently 45 ranking 36th-highest in the US. The latest sales tax rate for Tulsa County OK.

Oklahoma has a lower state sales tax than 885. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax.

Average Sales Tax With Local. The Oklahoma state sales tax rate is currently. Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states.

What S The Car Sales Tax In Each State Find The Best Car Price

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

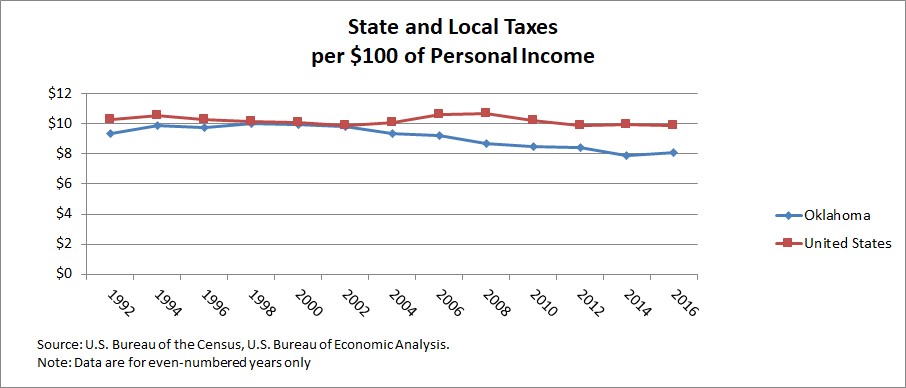

Oklahoma Tax History Oklahoma Policy Institute

How Oklahoma Taxes Compare Oklahoma Policy Institute

Hard Knocks Beyond Laser Tag Your Indoor War

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

Oklahoma Sales Tax Handbook 2022

How To Calculate Sales Tax Definition Formula Example

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

How To Calculate Sales Tax Video Lesson Transcript Study Com

Total Sales Tax Per Dollar By City Oklahoma Watch

Taxes Broken Arrow Ok Economic Development

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Aqua Lily Pad Lake Fun Floating In Water

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax